A pre-approval letter is basically your golden ticket to house hunting. It’s a document from a lender saying they’re likely to approve you for a loan up to a certain amount—based on some initial checks. While it’s not a final loan offer, it shows sellers you’re serious and financially ready to buy. In fact, many sellers won’t even consider your offer without one. So, if you’re thinking about buying a home, getting pre-approved is a smart first step!

Now that you’re preapproved, it’s time for the fun part—finding your dream home! Work with your real estate agent to tour homes, compare options, and narrow down your choices. If you need a realtor- click here

Once you and your agent find “the one,” your agent will help you craft a strong offer that fits your budget and market conditions. If the seller accepts, you’ll sign a purchase agreement, locking in the terms of the sale. This officially moves you one step closer to homeownership!

Congrats! You’ve got an accepted offer—now it’s time to make things official. Your real estate agent will send the signed purchase agreement to me, kicking off the loan process. From here, I start verifying details, processing your application, and preparing the next steps to move you toward closing. This is where things start to feel real! 🚀

Now it’s time to customize your mortgage! I will walk you through different loan options so you can choose the best fit for your situation. Locking in a rate secures your monthly payment, while floating rates give you flexibility if rates drop before closing. Either way, this step helps shape your mortgage to fit your financial goals! 💰🏡

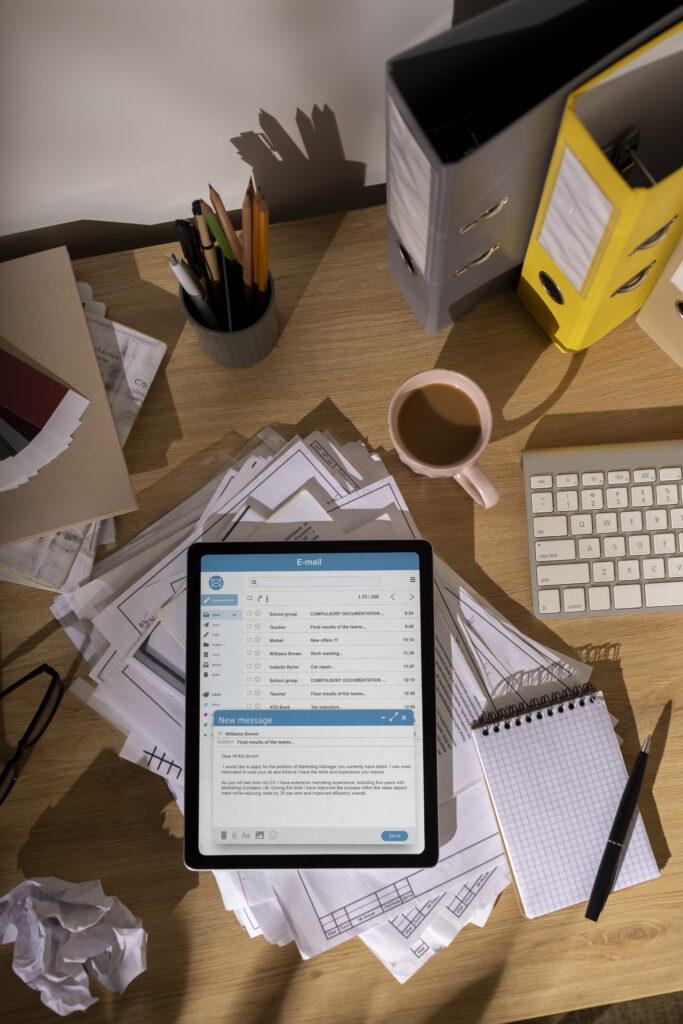

Here’s where we put everything in writing! I’ll send you your Loan Estimate (LE), which breaks down your estimated loan terms, interest rate, and closing costs. This is your chance to review the details and make sure everything looks good. Since these numbers are preliminary, they may change slightly before closing. Once you’ve gone through everything, you’ll e-sign the disclosures to acknowledge receipt—an important step to keep your loan moving forward. If anything seems off, don’t hesitate to ask questions!

Now that your loan disclosures are signed, it’s time for some behind-the-scenes work. Next, we’ll order an appraisal to confirm the home’s value and ensure it aligns with the loan amount. At the same time, a title company will conduct a title search to make sure there are no outstanding liens or ownership issues with the property. This step ensures you’re buying a legally sound home with a clean history.

Pro Tip: This is also the perfect time to shop for and secure homeowners insurance—you’ll need it before closing!

This is where the lender takes a deep dive into your financials. The underwriting team carefully reviews your income, credit, assets, and the property details to make sure everything meets loan guidelines. They may ask for additional documents, like updated bank statements, proof of earnest money deposit, or a final employment verification. This is totally normal, so stay ready to send any requested paperwork quickly—keeping things moving smoothly!

Pro Tip: During the homebuying process, please refrain from making any large purchases or opening any new lines of credit! The better credit you have, the better interest rate you will receive from the lender!

Good news! If everything checks out, the underwriter will issue a conditional approval. This means your loan is almost ready, but there are a few final things to clear before getting the green light. These “conditions” could be as simple as submitting one last pay stub or clarifying a transaction on your bank statement. Handle these ASAP so you can move on to the final approval stage!

This is the moment you’ve been waiting for—your loan is officially approved! When you receive Clear to Close (CTC), it means all conditions have been met, and you’re ready for the final steps before closing day. Your lender will now prepare all the final closing documents and coordinate with the closing attorney or title company to get everything in place. Almost there!

Your Closing Disclosure (CD) will be sent to you at least three days before closing. This document lays out all your final loan terms, interest rate, monthly payment, and closing costs. Take your time reviewing it—compare it with your Loan Estimate and flag anything that looks off. If you have questions or notice discrepancies, contact me so we can get it fixed before closing day!